When I was small, my parents gave me a ledger book and taught me how to use it. In it I tracked the money I received or earned and where it went. I learned to save and could see what I had to spend and what I had accumulated to donate to charity. Now when my kids receive their first few dollars, usually as a gift long before they know what money is, I go and get them their own ledger book and write it in.

I like the 6 column book, you’ll see how I use all the columns below. I got my last ledger at Staples for $9.29, though I see one on Amazon for just $8.79. One book is all they’ll ever need.

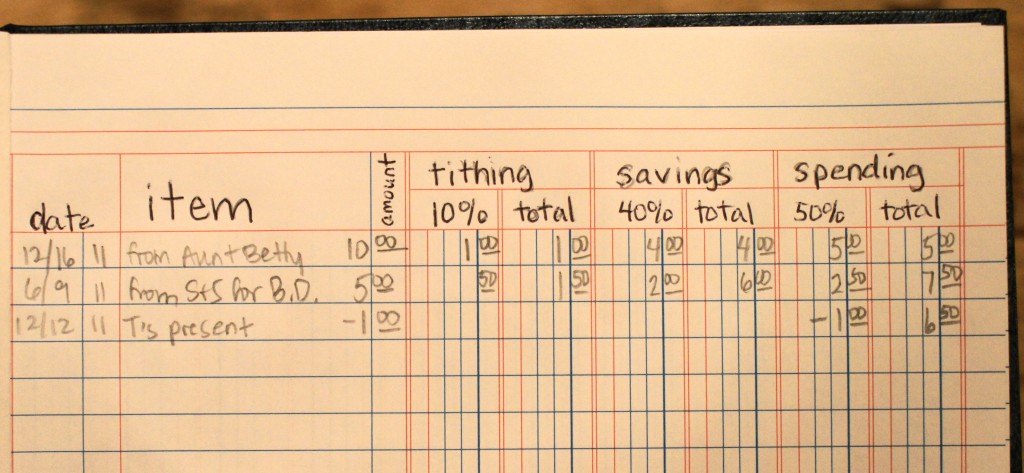

The 6 columns are really 3 split in half. We have our income split into three categories, 10% goes to charity (tithing), 40% goes into savings, and 50% is for spending. The kids sometimes complain that in order to earn enough to buy something for $20, they have to earn $40! But the real world is even tougher than that, so they might as well get used to it. The total received or spent is written under “amount”, with a minus sign if money is going out. Then under each category is the breakdown for that exchange and then a running total. When the child is ready to pay their tithing or take the savings to the bank, it is written in as negative and that total goes back to zero. This book is a record of the money they have at home. If they have a bank account, that money would be kept track of somewhere else.

My kids don’t always enjoy having to write in each dollar they earn. Nor when they find something they want to buy and I say, “Okay, when we get home, let’s see if you have that much in ‘spending’ in your money book, and if you can afford it and still want it, you can buy it.” When money in their jar doesn’t add up to what’s written in the book, the missing money must come out of spending, also not pleasant. But I’m glad that they are learning about the value of money and the responsibility of having it. And there is security in knowing what you’ve got and realizing you can make choices that affect your financial situation.

There are other perks, too. Like when my son’s scoutmaster said they were going to get the Personal Management merit badge and would need to keep track of the money they earned and spent. He brought his book and showed it to him, and that requirement was signed off quick. Now he keeps track of his money on the computer and I can’t check up on him, but hopefully he doesn’t need me too because he learned what he needed to early on.